Apr 27, 2006 — Fair value is based bonactively quoted imrket`prices, if available-. In the absence of ac-tively q6ut6d marWet prices, we seek indicative price

142 KB – 169 Pages

PAGE – 1 ============

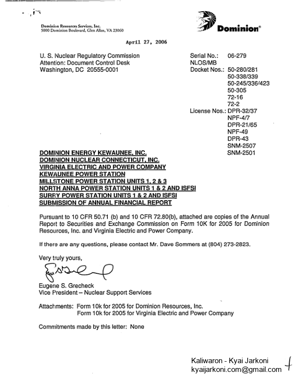

V-0£# Dominion®Dominion Resources Services, Inc.5000 Dominion Boulevard, Glen Allen, VA 23060April 27, 2006U. S. Nuclear Regulatory Commission SeAttention: Document Control Desk NLWashington, DC 20555-0001 DcLicDOMINION ENERGY KEWAUNEE, INC.DOMINION NUCLEAR CONNECTICUT, INC.VIRGINIA ELECTRIC AND POWER COMPANYKEWAUNEE POWER STATIONMILLSTONE POWER STATION UNITS 1. 2 & 3NORTH ANNA POWER STATION UNITS 1 & 2 AND ISFSISURRY POWER STATION UNITS 1 & 2 AND ISFSISUBMISSION OF ANNUAL FINANCIAL REPORTrial No.:LOS/MB06-279ocket Nos.: 50-280/28150-338/33950-245/336142350-30572-1672-2,ense Nos.: DPR-32/37NPF-4/7DPR-21/65NPF-49DPR-43SNM-2507SNM-2501Pursuant to 10 CFR 50.71 (b) and 10 CFR 72.80(b), attached are copies of the AnnualReport to Securities and Exchange Commission on Form 10K for 2005 for DominionResources, Inc. and Virginia Electric and Power Company.If there are any questions, please contact Mr. Dave Sommers at (804) 273-2823.Very truly yours,Eugene S. GrecheckVice President -Nuclear Support ServicesAttachments: Form 1 Ok for 2005 for Dominion Resources, Inc.Form 1 Ok for 2005 for Virginia Electric and Power CompanyCommitments made by this letter: None(KAcb)4

PAGE – 2 ============

–SN 06-2792005 Annual Financial Reportcc: U. S. Nuclear Regulatory CommissionRegion I.475 Allendale RoadKing of Prussia, PA 19406-1415U. S. Nuclear Regulatory CommissionRegion IISam Nunn Atlanta Federal Center’1 Forsyth St., SW, Suite 23 T85Atlanta, GA 30303-8931U. S. Nuclear Regulatory CommissionRegion IlIl2443 Warrenville RoadSuite 210Lisle, IL 60532-4352,Mr. V. NersesSenior Project ManagerU. S. Nuclear Regulatory CommissionOne White Flint North11555 Rockville PikeMail Stop 8C2Rockville, MD 20852-2738Mr. A. B. WangProject ManagerU. S. Nuclear Regulatory CommissionOne White Flint North11555 Rockville PikeMail Stop 7E1Rockville, MD 20852-2738Mr. S. R. MonarqueProject ManagerU. S. Nuclear Regulatory Commission-One White Flint North11555 Rockville PikeMail Stop 8H12Rockville, MD 20852-2738

PAGE – 3 ============

i 1=SN 06-2792005 Annual Financial ReportMr. D. H. JaffeProject ManagerU. S. Nuclear Regulatory Commission-One White Flint North11555 Rockville PikeMail Stop 7 D1Rockville, MD 20852-2738Mr. S. M. SchneiderNRC Senior Resident InspectorMillstone Power Station/Mr. J. T. ReeceNRC Senior Resident InspectorNorth Anna Power StationMr. N. P. GarrettNARC Senior Resident InspectorSurry Power StationMr. S. C. BurtonN1RC Senior Resident InspectorKewaunee Power StationDirector, Spent Fuel Projects OfficeOffice of Nuclear Material Safety and Safeguards’i. S. Nuclear Regulatory CommissionWashington, DC 20555-0001Mr. J. E. Reasor, Jr.Old Dominion Electric CooperativeInnsbrook Corporate Center4201 Dominion Blvd.Suite 300Glen Allen, VA 23060

PAGE – 4 ============

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549FORM 10-K(Mark One)E1 ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934For the fiscal year ended December 31, 2005ORD1 TRANSIrION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934For the transition period from toCommission File Number 001-08489DOMINION RESOURCES, INC.(Exact name of registrant as specified in its charter)Virginia 54-1229715(State or other jurisdiction (I.R.S. Employerof incorporation or organization) Identification No.)120 Tredegar StreetRichmond, Virginia 23219(Address of principal executive offices) (Zip Code)(804) 819-2000(Registrant’s telephone number)Securities registered pursuant to Section 12(b) of the Act:Name of Each ExchangeTitle of Each Class on WN’hich RegisteredCommon stock, no par value New York Stock Exchange8.75% Equity income securities, $50 par New York Stock Exchange8.4% Trust preferred securities, $25 par New York Stock ExchangeSecurities registered pursuant to Section 12(g) of the Act:NoneIndicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the SecuritiesAct. Yes IX No EiIndicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the ExchangeAct. Yes Li No ExIIndicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of tfe Secu-rities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file suchreports), and (2) has been subject to such filing requirements for the past 90 days. Yes 1ZI No LIIndicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, andwill not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by referencein Part III of this Form 10-K or any amendment to this Form 10-K. Fx1Indicate by cdeck mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. Seedefinition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.Large accelerated filer [E Accelerated filer L Non-accelerated filer LIndicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the ExchangeAct). Yes Li No nXThe aggregate market value of the common stock held by non-affiliates of the registrant was approximately $24.6 billionbased on the closing price of Dominion’s common stock as reported on the New York Stock Exchange as of the last day of theregistrant’s most recently completed second fiscal quarter.As of February 1, 2006, Dominion had 347,479,911 shares of common stock outstanding.DOCUMENT INCORPORATED BY REFERENCE.(a) Portions of the 2006 Proxy Statement are incorporated by reference in Part Ill.

PAGE – 5 ============

Dominion Resources, Inc.Item PageNumber NumberPart I1. Business 11A. Risk Factors 111 B. Unresolved Stalf Comments 122. Properties 133. Legal Proceedings .. 164. Submission of Matters to a Vote of Security Holders .. 16Executive Officers of the Registrant .. 17Part II5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities .. 186. Selected Financ al Data 187. Management’s Discussion and Analysis of Financial Condition and Results of Operations . 197A. Quantitative and Qualitative Disclosures About Market Risk .. 418. Financial Statements and Supplementary Data 439. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure . 879A. Controls and Prccedures .. 879B. Other Information .. 88Part III10. Directors and Executive Officers of the Registrant . 8911. Executive Compensation .. 8912. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters .. . 8913. Certain Relation:,hips and Related Transactions .. . 8914. Principal Accountant Fees and Services .. . 89Part IV15. Exhibits and Financial Statement Schedules . . 90* This copy of the Annual Report on Form 10-K incorporates some corrections to minor typographical errors which are the subject of ourForm 10-K/A filed with the Securities and Exchange Commission on March 7, 2006 in File No. 001 -08489.

PAGE – 6 ============

Part iD1oo ‘n Y1 C i:”). < 7'1"':I ;f 2V-1 ' rrsif1r, ifIl .r btI- > CVW ;ottC: Ct.nns Io r1Q le 2. f. > -9o .13 c>) y’.:1 t’i”‘.tl .’i”1’i0q L 1^’ .;” i :” 1JThe’Co’mpany 1 ; (’13 no bowl ‘- ,.t. -. ., ,.i, , rlo ,il,. .-t n. ii-S : .: .Dominion Resources, Inc. (Dominion), Js a fully jntegrated gas ,and electric holding company headquartered In Richmond, *, lo. ,Virginia. Dominion was incorporated In Virginia In 1983.Dominion concentrates its efforts largely In the energyintensive Northeast, Mid-Atlantic and Midwest regions6of th’e”t ‘3United States.This area, which stretches from Wisconsin, Illinoisand adjoining states through -our primary Mid-Atlantic service , *areas in Ohio,’Pennsylvania, West Virglnia,.Virginia and North , i-)Carolina;’and up through New York and New England, is home toapproximately 40% of the nation’s demand for energy. l, .^ ot,The terms. Dominion,”iCompany,. ‘,we,”? four’tand ‘us”,areused throughout this report and, depending on the context oftheir use, may represent any of the following: the legal entity,Dominion Resources, Inc., one of Dominion ResourcesInc.’ Aconsolidated subsidiariesor operating segments orthe entirety !of Dominion Resources; Inc. and Its consolidated subsidiaries..iiiOur principal direct legal subsidiaries are Virginia Electric andPower Company (Virginia Power),’ Consolidated Natural Gas”‘o. 0Company (CNG), Dominion Energytlnc. (DEI) and Virginia PowerqEnergy Marketing Inc.#(VPEM).’.Virginia Power is a regulated’ -.i ;public utility that generates, transmits and distributes electricity.for sale In Virginia and northeastern North Carolina: CNG oper-ates in’all phases of the natural gas business, explores’for and’!produces natural gas and oil and provides -a variety of energy , 1.marketing services. In addition, CNG Is a transporter, distributor-and retail marketer bf natural gas, serving customers in Pennsyl-vania,-OhioWest Virginia and other states: CNG also operates aliquefied natural gas (iNG) Import and storage facility In MaryX -land. DEI Is Involved In merchant generation,, energy marketing ,’and risk-management activities and natural gas and oil explora-3tion ‘and production. VPEM provides fuel and risk management !fiservices to Virginia Power and other Dominion’affiliates and .engages in energy trading activities. VPEM was formerly an t010.2Indirect wholly-owned subsidiary of Virginia Power,; however on AtDecember 31, 2005, Virginia Power transferred VPEM to tI *:TDominion through ‘a ‘series of dividend distributions.; :;nivjym;;:1r 0As of December 31; 2005, we had approximately 17,400 full-time employees;Approxlmately’6,300 employees are subject to)collective bargaining agreements.,c3& en ‘v) Xl x ” ‘Our principal executive offices are located at 120 Tredegar Ili,Street; Richmond,’Virginia 23219 and our telephone’ numberis X’.(804) 819-200.;rio( ]IT .’orfifS. 0 ! lanioq freon) ?1 o00L fi6lf 111 ;f~l;, rj;l’f95.e~~~b ?y-‘i:r i~’iibtoifrJFni 000,8? F srunxP;q rJ. a”i:’.. o it91C:lOperating SegmentsWe manage our operations through four primary operatingsegments: Dominion Delivery, Dominion Energy, DominionGeneration and Dominion Exploration & Production. We alsoreport Corporate and other functions as a segment. While wemanage our daily operations through segments, our assetsremain wholly-owned by our legal subsidiaries. For additionalfinancial information on business segments and geographicareas, including revenues from external customers, see Note 28to our Consolidated Financial Statements. For additional.4Zw5 f fir J UC’n2Xoi ‘ui.; ¶ ‘i r~ “!-” ;l o ‘~- r ‘.’ ‘v’t. 3fs’;Q ~ s<.UFir'1aiNI 1')'. bnzc r 'f '~'~ o 1.; [1)jinformation on operating revenue related to our principal prod- 'oucts and services see Note 6 to our Consolidated Financial; .ii;f0Statements. ;"\t'- ' ! .jo Ci 7''1 ' f '1r;r.i 1cr.oiI.tfDominion DeliveryDominion Delivery includes our regulated electric and gas di'iskstributlon and customer service businessas well as nonregulated Iretail energy markeUng operations. Electric distribution operationsserve residential, commercial, Industrial and governmental ai cdQcustomers In Virginia and northeastern North Carolina. Gas dis-tribution operations serve resldentialcommerclal and industrial. lgas 'sales and transportation customers in Ohio, Pennsylvania yt-and West Virginia. Nonregulated retail energy marketing oper-: narations include the marketing of gas, electricity and related prod- 'Aucts and services to residential, industrial and small commercialcustomers in the Northeast, Mid-Atlantic and Midwest.,;, .n;tCompetitionWithin Dominion Delivery's service territory in Virgini'aln'd North'-Carolina,4there is'no competition for electric distribution servicedDeregulation Js at varying stages'in the three states In which',our gas distribution subsidiaries operated 'In Pennsylvania,c'; i *-,supplier choice is available for all residential and small commer--cial customers. In Ohio, legislation has not been enacted torequire supplier choice for residential and commercial naturalgas consumers. However, we offer an Energy Choicepprogram tocustomers on our own initiativ6 in 'cooperation with the Public A2Utilities Commission of Ohi6 (Ohio Commission).-West Virginia-,.does not require customer choice in Its retail riatural 'gas mar-s'r!]kets'at this time. See 'Regulationh-State Regulations2'-Gas formcadditional Information.':' ;o nag flC ' " to 'i2.o" siibsnrji20o f,~ Olls.^n-1-.rf !{u.r.se J 341o''iW'pribrftvl vn.nE i;.!!2,!~ 'i'l( ~'i~g0-l VIt7~ il'.Dominion Delivery's electric retail service; including the rates it admay charge 'to customers;'is subject to regulation by the.Virginia>State Corporation Commission (Virginia Commission) and the ,,ioNorth Carolina Utilities Commission (North Carolinazs t:,i–;. FUZ.Commission). See Regulation-State Regulations-Electric foradditional information.Dominion Delivery’s gas distribution service, Including rates’that It nmay charge customers. is regulated by the Ohio Commis-:2slon,ltthe Pennsylvania Public Utility ‘Commission (Pennsylvania’MCommission) arid the West Virginia Public ServiceCommisslon -o(West Virginia Commission). ‘See Regulation-State:Regu-”:2 aIations-Gas for additional friformation! o’mornv U) !PropertiesDominion Delivery’s electric distribution network Includes approx-Imately 54,000 miles of distribution lines, exclusive of servicelevel lines, in Virginia and North Carolina. The right-of-way grantsfor most electric lines have been obtained from the apparentowner of real estate, but underlying titles have not been exam-ined. Where rights-of-way have not been obtained, they could beacquired from private owners by condemnation, if necessary.Many electric lines are on publicly owned property, wherepermission to operate can be revoked.1

PAGE – 8 ============

The map oelow illustrates our gas transmission pipelines, storage facilities, LNG facility and electric transmission lines.”‘ i , 1, I* -~ , , ,, , .:, ,, ,, ,I ,, , g .I ; , i ‘ , ‘. ,.1,I, .- i. .1-. rfl;7.I {;4)’c’-,F-I.I !.r. I, II I1.-Natural Gas Transmission Pipelines–Natural Gas Transmission PipelinesI.., , , .: ” ‘! : iV .1..lx V I .C,. ., , .IISources of Eriergy Suppi ‘ * ‘Our large underground natural gas storage network and the loca-tion of our pipeline-system are a significant link between thecountry’s major gas pipelines and large markets in the Northeastand Mid-Atlanlic regions. Our pipe!ines are part of an inter-connected gas transmission system, which continues to providelocal distribution companies, marketers, power generators andindustrial and commercial customers accessibility to suppliesnationwide.,-, ..! ; ;Our underground storage facilities play an important part inbalancing gas supply with consumer demand and are essential toserving the Midwest, Mid-Atlantic and Northeast regions. In addi-tion, storage capacity is an important element in the effective:,,management cf both gas supply and pipeline transport capacity.’Seasonality I- I} ! ,;Dominion Energy’s business is affected by seasonal changes inthe prices of commodities that it transportsand actively marketsand trades.Dominion GenerationDominion Generation’s electric utility and merchant fleetincludes approximately 28,100 megawatts (Mw) of generationcapability. The generation mix is diversified and includes coal,nuclear, gas, oil, hydro and purchased power. Our strategy forour electric generation operations focuses on serving customers(Partnership) .; , _ Natural Gas Underground Storage PoolsElectric Transmission Lines(Bulk delivery)A Cove Point LNG Facility .. ‘ ..in the energy intensive Northeast, Mid-Atlantic and Midwestregions of the United States.-Our generation facilities are located in Virginia,’ West Virginia,North Carolina, Connecticut, Illinois, Indiana, Pennsylvania, Ohio,Massachusetts, Rhode Island and Wisconsin. Dominion Gen-eration also includes energy marketing and risk managementactivities associated with the optimization of generation assets.CompetitionRetail choice has been available f6r Dominion GenerEtion’sVirginia jurisdictional electric utility customers since January 1,2003; however, to date, competition in Virginia has not devel-oped to the extent originally anticipated. See Reguiatton-StateRegulations: Currently, North Carolina does not offer retail choiceto electric customers.Dominion Generation’s merchant generation fleet owns andoperates several large facilities in the Midwest. The output fromthese generating plants is sold under long-term contracts and istherefore largely unaffected by competition.The majority of Dominion Generation’s remaining merchantassets operate within functioning RTOs. Competitors includeother generating assets bidding to operate within the RTOs.These RTOs have clearly identified market rules that ensure thecompetitive wholesale market is functioning properly. DominionGeneration’s merchant units have a variety of short arid medium-term contracts, and also compete in the spot market with othergenerators to sell a variety of products including energy, capacity3

PAGE – 9 ============

and operating reserves. It is difficult to compare various types ofgeneration given the wide range of fuels, fuel procurement strat-egies, efficiencies and operating characteristics of the fleetwithin any given RTO. However, management believes that wehave the expertise in operations, dispatch and risk managementto maximize the degree to which our merchant fleet is com-petitive compared to like assets within the region.RegulationIn Virginia and North Carolina, our electric utility generation facili-ties, along with power purchases, are used to serve our utilityservice area obligations. Due to amendments to the VirginiaRestructuring Act and the fuel factor statute in 2004, revenuesfor serving Virginia jurisdictional retail load are based on cappedbase rates through 2010 and the related fuel costs for thegenerating fleet, including power purchases, are subject to fixedrate recovery provisions until July 1, 2007, when a one-timeadjustment will be made effective through December, 2010.Such adjustment will be prospective and will not take intoaccount any over-recovery or under-recovery of prior fuel costs.Subject to market conditions, any generation remaining aftermeeting utility system needs is sold into PJM.PropertiesFor a listing of Dominion Generation’s generation facilities, seeItem 2. Properties.Sources of Fuel Supply -Dominion Generation uses a variety of fuels to power its electricgeneration, as described below.Nuclear Fuel-Dominion Generation primarily utilizes long-term contracts to support its nuclear fuel requirements. World-wide market conditions are continuously evaluated to ensure arange of supply options at reasonable prices. Current agree-ments, inventories and spot market availability are expected tosupport current and planned fuel supply needs. Additional fuel ispurchased as required to ensure optimal cost and inventorylevels.Fossil Fuel-Dominion Generation primarily utilizes coal, oiland natural gas in its fossil fuel plants. Dominion Generation’scoal supply is obtained through long-term contracts and spotpurchases. Additional utility requirements are purchased mainlyunder short-term spot agreements.Dominion Generation’s natural gas and oil supply is obtainedfrom various sources including: purchases from major andindependent producers in the Mid-continent and Gulf Coastregions; purchases from local producers in the Appalachian area;purchases from gas marketers; and withdrawals from under-ground storage fields owned by us or third parties.-We have a portfolio of firm natural gas transportation con-‘tracts (capacity) that allow flexible natural gas deliveries to ourgas turbine fleet, while minimizing costs.Seasonalitya, y , .Dominion Generation’s sales of electricity typically vary season-ally based on demand for electricity by residential and commer-cial customers for cooling and heating use based on changes intemperature.Nuclear DecommissioningDominion Generation has a total of seven licensed, operatingnuclear reactors, at its Surry and North Anna plants in Virginia, itsMillstone plant in Connecticut and its Kewaunee plant inWisconsin.Surry and North Anria serve customers of our regulated elec-tric utility operations. Millstone Is a nonregulated merchant plantwith two operating units. A third Millstone unit ceased operationsbefore we acquired the plant. In July 2005, we completed theacquisition of the 556-megawatt Kewaunee nuclear power sta-tion in eastern Wisconsin.Decommissioning represents the decontamination and removalof radioactive contaminants from a nuclear power plant once oper-ations have ceased, in accordance with standards established bythe Nuclear Regulatory Commission (NRC). Amounts collected fromratepayers and placed in trusts have been invested to fund futurecosts of decommissioning the Surry and North Anna units. As partof our acquisition of both Millstone and Kewaunee, we acquired thedecommissioning funds for the related units. Currently, we believethat the amounts available in our decommissioning trusts and theirexpected earnings will be sufficient to cover expected decom-missioning costs for the Millstone and Kewaunee units, without anyadditional contributions to those trusts.The total estimated cost to decommission our eight nuclearunits is $3.5 billion and is primarily based upon sitespecificstudies completed in 2002. We will perform new cost studies in2006. For all units except Millstone Unit 1 and Unit 2, the cur-rent cost estimates assumie decommissioning activities willbegin shortly after cessation of operations, which will occur whenthe operating licenses expire. Millstone’ Unit 1 is not in serviceand selected nilnor decommissioning activities are being per-formed. This unit will continue to be monitored until decom-missioning activities begin for the remaining Millstone units. Thecurrent operating licenses expire in the years detailed in thefollowing table. During 2005, the NRC approved Dominion’sapplication for a 20-year life extension for Millstone Units 2 and-3. We expect to decommission the Surry and North Anna unitsduring the period 2032 to 2045.: We expect to start minordecommissioning activities at Millstone Unit 2 in 2034, with fulldecommissioning to take place at Millstone Units 2 and 3 duringthe period 2045 to 2057. We plan to file an application for a 20-year life extension for our Kewaunee unit. If the NRC approvesthe application, we currently expect to decommission Kewauneeduring the period 2032 to 2042., ;,t..; !, IsI .-.I- 1t .!..: I.-.II I4

PAGE – 10 ============

Surry North Anna -Millstone KewauneeUnit 1 Unit 2 Unit 1 Unit 2 Unit 1 Unit 2 Unit 3 Un t 1 Total(millions)NRC license expiration year 2032 2033 2038 2040 lit 2035 2045 2013Most recent cost estimate $375 $368 $391- $363 $531 $486 $518 $440 $3,472Funds in trusts at December 31,2005 .. 326 321 266 252 285 327 322 434 2,5332005 contributic ns to trusts 1.5 1.7 1.1 1.1 .5.4(l) Unit 1 ceased olerations in 1998 before our acquisition of Millstone.Dominion Exploration & Production (E&P)Dominion E&P includes our gas and oil exploration, developimentand production operations. These operations are located inseveral major producing basins in the lower 48 states, inclutding’the outer continental shelf and deepwater areas of the Gulf ofMexico, and WVestern Canada.CompetitionDominion E&P”s competitors range from major, international oilcompanies to smaller, independent producers. Dominion E&Pfaces significant competition in the bidding for federal offshoreleases and in obtaining leases and drilling rights for onshoreproperties. As the operator of a number of properties, DominionE&P also faces competition in securing drilling equipment andsupplies for exploration and development.In terms a its production activities, Dominion E&P sells mostof its delivera )le natural gas and oil into short and intermediate-term markets. Dominion E&P faces challenges related to themarketing of its natural gas and oil production due to the con-traction of participants in the energy marketing industry. How-ever, Dominion E&P owns a large and diverse natural gas and oilportfolio and maintains an active gas and oil marketing presencein its primary production regions, which strengthens its knowl-edge of the marketplace and delivery options.Regulation ., AOur exploration and production operations are subject to regu-lation by numerous federal and state authorities. The pipelinetransportation of our natural gas production is regulated by FERCand pipelines operating on or across the Outer Continental Shelfare subject to the Outer Continental Shelf Lands Act whichrequires open-access, non-discriminatory pipeline facilities. Ourproduction operations in the Gulf of Mexico and most of ouroperations in the western United States are located on federaloil and gas leases administered by the Minerals ManagementService (MMS) or the Bureau of Land Management. Theseleases are issued through a competitive bidding process and’require us to comply with stringent regulations. Offsl-ore pro-duction facilities must comply with MMS regulations relating toengineering, construction and operational specifications and theplugging and abandonment of wells. Our production operationsare also subject to numerous environmental regulations includingregulations relating to oil spills into navigable waters of theUnited States. See Regulation-Federal Regulations and Regu-lation-Environmental Regulation for additional information.PropertiesDominion E&P owns 6.3 trillion cubic feet of proved e quivalent ofnatural gas and oil reserves and produces approximately 1.1billion cubic feet equivalent of natural gas per day from itsleasehold acreage and facility investments. We, either alone orwith partners, hold interests in natural gas and oil lease acreage,wellbores, well facilities, production platforms and gatheringsystems. We also own or hold rights to seismic data and othertools used in exploration and development drilling activities. Ourshare of developed leasehold totals 3.1 million acres, withanother 2.4 million acres held for future exploration Enddevelopment drilling opportunities. See also Item 2. Propertiesfor additional information on Dominion E&P’s properties. I ” 11V5

PAGE – 11 ============

DominionnExxp-loration & Production Proved Reserves(Major Operating Areas) —*. * -100 W I —– -.-_Proved Reserves (Bcfe)As of December 31, 2005:6,268Daily Production (Mmcfe day)1,050 ..Appalachian/,Michigan BasinProved Reserves (Bcfe): 1,255Doily Production IMmcfe/dqy]:tl 30El Gulf CoastProved Reserves’ Bcfe): 475 :Doily Production lMmcfe/doy):, 158El Gulf of Mexico ‘ ‘ 2 1-Proved Reserves (Bcfe): 986 .Daily Production (Mmcfe/doyl: 331E Mid-ContinentProved Reserves lBcfe): 703Doily Production lMmcfe/doy): 108El PermianProved Reserves (Bcke): 2,096 ;Daily Production (Mmcfe/doy):.168E Rocky Mountain/Other. ,Proved Reserves (Bcfe): 533Doily Production lMmcfe/dcay): 100i CanadaProved Reserve; (Bcfe):220-Dcily Production (Mmcfe/doy):55 -..Note: Includes the activities of the Dominion E&P segment and the production activity of Dominion Transmission. Inc.’which is included in the Dominion Energy segment); I ‘ ;’ iBcfe = billion cubic feet equivalent .; , ‘- ,, -i;Mmcfe = million cubic fee,SeasonalityDominion E&P’s busiin the demand for nalincluding prices’for o0can be affected by seeffects.tequivalent *.. ..-, .State Regulations ; ,- v i-, .ss an e affected by se changes Electric –;,-: rnes ca be seasonalch n etural gas and oil. Commodity prices, , Our electric retail service is subject to regulation by the Virginiar unhedged natural gas ad Commission and the North Carolina Commission.,easonal weather changes and weather Our electric utility subsidiary holds certificates of public-‘ -convenience and necessity authorizing it to maintain and operateits electric facilities now in operation and to sell electricitytocustomers. However, it may not construct or incur financial